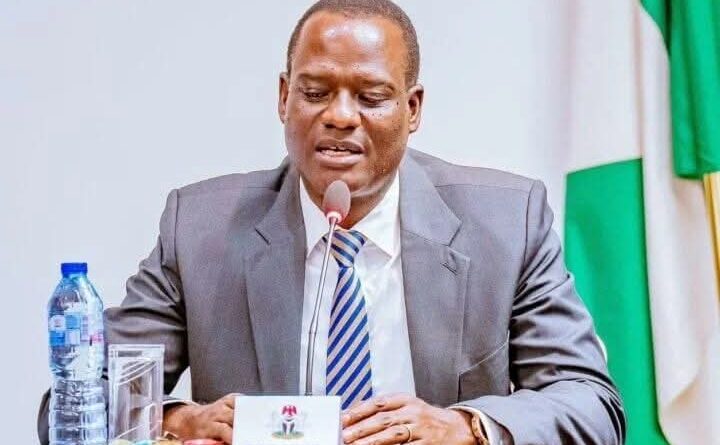

VAT collection is not treated like other revenues, Taiwo Oyedele fired back to RMAFC

Taiwo Oyedele, chairman of the presidential committee on tax policy and fiscal reforms, has asked the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) to focus on finding a workable solution rather than causing more controversies.

On December 9, RMAFC opposed the value-added tax (VAT) sharing formula proposed in the tax reform bills, citing constitutional breaches.

According to the commission, the 1999 constitution (as amended) grants it the sole authority to determine the formula for equitable revenue sharing among the three tiers of government.

Providing clarifications on X on Wednesday, Oyedele said tax predates the 1999 constitution despite having been in operation for over 5 years.

“The tax is not mentioned in the 1999 Constitution making it a residual matter within the purview of the states,” he posted.

“As a result of the above, VAT is paid into a special pool account and not treated along with the other revenues accruable to the federation for which the RMAFC is expected to play an advisory role regarding the sharing formula as contained in section 162 of the 1999 Constitution.

“A similar revenue item is stamp duties which also belong to states and it is meant to be shared among them based on 100% derivation without any requirement for the RMAFC to be involved in determining the sharing formula.”

‘VAT FOR WHERE GOODS ARE CONSUMED NOT WHERE TAXPAYERS RESIDE’

The committee chairman further said the proposed VAT revenue-sharing formula in the tax bills along with the other VAT reform proposals is meant to address key issues which are existential to the current VAT regime.

He also explained that the VAT, unlike income tax, operates as a consumption-based levy, where revenue is tied to the location where goods and services are consumed, not where taxpayers reside or businesses are registered.

“VAT consumption needs to be determined based on taxpayer residence. This is not the case with VAT or any consumption tax unlike income tax,” Oyedele said.

“The illustration regarding the purchase of an asset in Lagos for use in Kano does not pose any difficulties as VAT has an inbuilt mechanism for input and output VAT where only the VAT related to incremental value added in a jurisdiction will be attributed to such location with production treated as intermediate consumption at each stage of the production process prior to the final consumption.

“There is no need for any technology to track the location of consumption, every eligible business will simply be required to indicate the location of sales in its VAT returns as stipulated under section 22(12) of the Nigeria Tax Administration Bill.

“It is not necessary to tag VAT collections to end-user locations from sale to consumption, neither is it practical to do so. Afterall we may not be able to tag services or creative work that are digitally delivered as intangible goods.”

According to Oyedele, the horizontal distribution of VAT revenue among states is not based on a formula of 50 percent derivation, 35 percent population and 15 percent equality as stated by the commission but rather 20 percent derivation, 50 percent equality and 30 percent population.

“We are aware of various efforts by the RMAFC over the past decade including the nationwide consultation exercise on the review of the federation revenue sharing formula 3 to 4 years ago,” he said.

“Not only was VAT excluded from this exercise despite the apparent inequity in the distribution formula, the outcome of the revenue sharing consultation is yet to be concluded many years after.

“VAT administration is already under dispute, therefore seeking a political solution to avoid the risk of the tax being adjudged as a tax to be administered by states requires urgent action.”

The committee chairman urged RMAFC to join the ongoing effort including consultation with key stakeholders to arrive at a generally acceptable outcome.

Oyedele also said this period calls for a constructive and objective approach focusing on finding a workable solution, avoiding further controversies and working together to move Nigeria forward.