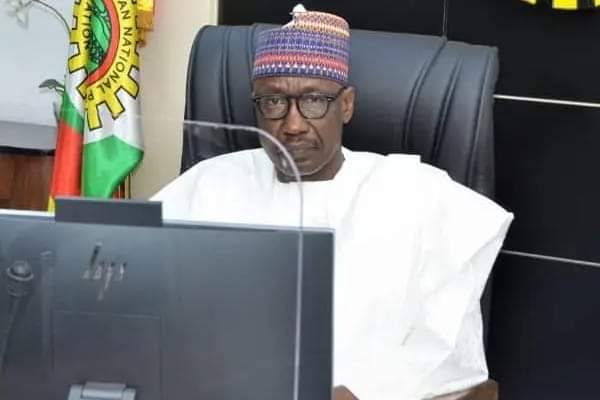

Nigerians could be gearing up for more tougher time as Nigeria National Petroleum Company Limited (NNPCL) on Sunday admitted that its financial trouble may affect the sustainability of petrol supply.

Though, the sudden admittance is coming following reports that it is indebted to suppliers to the tune of $6 billion.

Despite the financial challenges, the worsening situation has forced NNPCL to resort to stock rationing and appeal to major suppliers to continue deliveries.

Over the weekend, it was reported that no fewer than five vessels destined for Nigeria blatantly refused to discharge their fuel cargoes due to fears of non-payment.

Also, it was learnt that the $300 million bailout by President Bola Tinubu’s administration was not enough for the company to sustain petrol supply nationwide.

Only a few filling stations had the product to dispense to end-users Sunday, compelling desperate motorists to queue for hours in Lagos, Abuja and other cities.

Moreover, the bad situation has provided an opportunity for independent marketers to hike prices, with reports indicating that petrol was sold for as high as N950 per litre in some parts of Lagos and even higher in other states.

Meanwhile, in a statement by the spokesman of NNPCL, Mr Olufemi Soneye, the company confirmed the staggering debt and the pressure it has placed on operations.

The statement partly reads, “NNPC Ltd has acknowledged recent reports in national newspapers regarding the company’s significant debt to petrol suppliers. This financial strain has placed considerable pressure on the company and poses a threat to the sustainability of the fuel supply.

“In line with the Petroleum Industry Act (PIA), NNPC Ltd remains dedicated to its role as the supplier of last resort, ensuring national energy security. We are actively collaborating with relevant government agencies and other stakeholders to maintain a consistent supply of petroleum products nationwide.”